Play-to-earn is getting a second wind — and this time, it looks far more grounded.

MoneyTime, a mobile app that lets users earn real cash by playing games, has raised a $3 million seed round led by Arcadia Gaming Partners, the investment firm founded by Akin Babayigit.

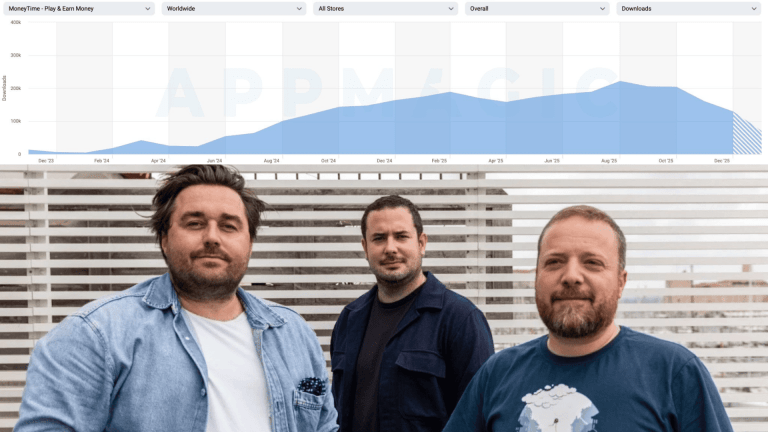

Launched in January 2024, MoneyTime is already live across 30 countries and has crossed 3 million installs worldwide, according to AppMagic — a notable signal in a category many wrote off too early.

⚡ A Different Take on Play-to-Earn

MoneyTime isn’t pitching crypto wallets or speculative tokens.

Instead, the product focuses on a simple value exchange:

players spend time playing games — and get real money payouts in return.

It’s a model designed to fit naturally into rewarded behavior, blurring the line between:

casual gaming

reward apps

and performance-based engagement

And crucially, it’s built for scale-first markets, not niche web3 audiences.

📊 Early Traction Snapshot (via AppMagic)

MoneyTime’s early metrics already show momentum:

3M+ installs globally

Live in 30 countries

70K+ average DAU

Retention curves that outperform typical reward apps

Not breakout yet — but clearly past zero-to-one risk.

⭐ Highlighted Signal

Crossing 3 million installs in under a year shows that play-to-earn didn’t fail —

it just needed a model that respected user behavior, not speculation.

🧠 Team with Monetization DNA

MoneyTime is led by David White, a former AppLovin executive, alongside co-founders Benoit Prunneaux and Hugo Gervais de Lafond.

That background matters.

This isn’t a team experimenting blindly — it’s a group that understands:

rewarded engagement loops

monetization psychology

and how to scale performance-driven products globally

White summed up the company’s direction clearly:

“Our mission is to put players back at the heart of the monetisation model as we accelerate our roadmap.”

🦄 Why Arcadia Backed It

For Arcadia Gaming Partners, the bet isn’t on buzzwords — it’s on execution.

Akin Babayigit described the MoneyTime team as “resourceful”, pointing to:

strong early traction

rapid market expansion

and a product aligned with real user incentives

In other words: less hype, more fundamentals.

🔮 Why This Matters

The first wave of play-to-earn collapsed under complexity.

MoneyTime’s approach flips the script:

No financial abstraction

No learning curve

No false promises

Just play → earn → repeat, powered by modern UA, monetization logic, and disciplined execution.

If play-to-earn is coming back, this is what it looks like in 2026.

🚀 What’s Next

With fresh capital, MoneyTime plans to:

Expand into additional high-engagement markets

Accelerate its game and partner roadmap

Deepen monetization efficiency without sacrificing trust

This isn’t about reinventing gaming.

It’s about re-aligning incentives.

And that’s why this round matters.

📨 Get Exclusive Reports

Perfect for developers, publishers, investors, and mobile gaming enthusiasts looking to stay updated on what’s scaling, what’s trending, and where the next big opportunity is emerging.

Unlocking tomorrow’s hits today: Trend insights , market research and ideation services for game studios.